Iowa Property Tax Exemption . all grain so handled shall be exempt from all taxation as property under iowa law. In 2021, the iowa legislature passed sf 619. an exemption is a reduction in the taxable value of the property rather than a direct reduction in the amount of property tax. an exemption is a reduction in the taxable value of the property rather than a direct reduction in the amount of property tax. tax credits, deductions & exemptions guidance. When you buy a home, you can apply for a homestead credit. Types of grain included and. how do i file a homestead exemption? Division 28 of that bill. iowans age 65+ have until july 1 to apply for a new property tax exemption included in legislation signed into law in may 2023.

from www.formsbank.com

Division 28 of that bill. tax credits, deductions & exemptions guidance. When you buy a home, you can apply for a homestead credit. Types of grain included and. how do i file a homestead exemption? an exemption is a reduction in the taxable value of the property rather than a direct reduction in the amount of property tax. all grain so handled shall be exempt from all taxation as property under iowa law. an exemption is a reduction in the taxable value of the property rather than a direct reduction in the amount of property tax. In 2021, the iowa legislature passed sf 619. iowans age 65+ have until july 1 to apply for a new property tax exemption included in legislation signed into law in may 2023.

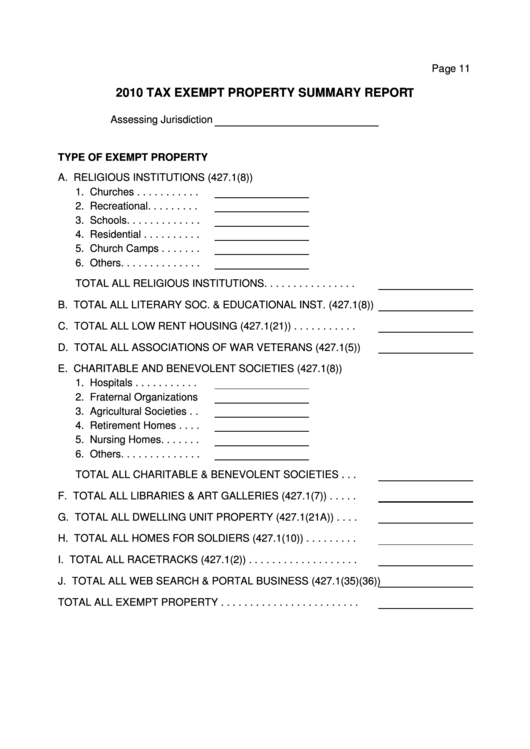

Tax Exempt Property Summary Report Iowa Department Of Revenue 2010

Iowa Property Tax Exemption In 2021, the iowa legislature passed sf 619. Types of grain included and. iowans age 65+ have until july 1 to apply for a new property tax exemption included in legislation signed into law in may 2023. In 2021, the iowa legislature passed sf 619. an exemption is a reduction in the taxable value of the property rather than a direct reduction in the amount of property tax. tax credits, deductions & exemptions guidance. Division 28 of that bill. how do i file a homestead exemption? When you buy a home, you can apply for a homestead credit. an exemption is a reduction in the taxable value of the property rather than a direct reduction in the amount of property tax. all grain so handled shall be exempt from all taxation as property under iowa law.

From lorellewnora.pages.dev

Iowa Tax Exempt Form 2024 Calla Corenda Iowa Property Tax Exemption Types of grain included and. how do i file a homestead exemption? When you buy a home, you can apply for a homestead credit. Division 28 of that bill. an exemption is a reduction in the taxable value of the property rather than a direct reduction in the amount of property tax. all grain so handled shall. Iowa Property Tax Exemption.

From islandstaxinformation.blogspot.com

Iowa Property Tax Calculator Iowa Property Tax Exemption an exemption is a reduction in the taxable value of the property rather than a direct reduction in the amount of property tax. In 2021, the iowa legislature passed sf 619. Division 28 of that bill. When you buy a home, you can apply for a homestead credit. how do i file a homestead exemption? an exemption. Iowa Property Tax Exemption.

From www.bentoncountyia.gov

Property Taxes Treasurer Benton County, Iowa Iowa Property Tax Exemption iowans age 65+ have until july 1 to apply for a new property tax exemption included in legislation signed into law in may 2023. tax credits, deductions & exemptions guidance. all grain so handled shall be exempt from all taxation as property under iowa law. Types of grain included and. In 2021, the iowa legislature passed sf. Iowa Property Tax Exemption.

From www.youtube.com

Who is exempt from paying property taxes in Iowa? YouTube Iowa Property Tax Exemption an exemption is a reduction in the taxable value of the property rather than a direct reduction in the amount of property tax. In 2021, the iowa legislature passed sf 619. Division 28 of that bill. all grain so handled shall be exempt from all taxation as property under iowa law. tax credits, deductions & exemptions guidance.. Iowa Property Tax Exemption.

From giogbekpj.blob.core.windows.net

Iowa Property Tax Veterans at Hobert Graham blog Iowa Property Tax Exemption iowans age 65+ have until july 1 to apply for a new property tax exemption included in legislation signed into law in may 2023. an exemption is a reduction in the taxable value of the property rather than a direct reduction in the amount of property tax. Types of grain included and. how do i file a. Iowa Property Tax Exemption.

From learningschoolhappybrafd.z4.web.core.windows.net

Sales Tax Exemption Form Sd Iowa Property Tax Exemption Division 28 of that bill. In 2021, the iowa legislature passed sf 619. Types of grain included and. how do i file a homestead exemption? When you buy a home, you can apply for a homestead credit. all grain so handled shall be exempt from all taxation as property under iowa law. an exemption is a reduction. Iowa Property Tax Exemption.

From www.yumpu.com

Streamlined Sales Tax Certificate of Exemption State of Iowa Iowa Property Tax Exemption tax credits, deductions & exemptions guidance. all grain so handled shall be exempt from all taxation as property under iowa law. how do i file a homestead exemption? Division 28 of that bill. iowans age 65+ have until july 1 to apply for a new property tax exemption included in legislation signed into law in may. Iowa Property Tax Exemption.

From www.formsbank.com

Form 54269a Iowa Property Tax Exemption Application For Certain Iowa Property Tax Exemption all grain so handled shall be exempt from all taxation as property under iowa law. Division 28 of that bill. an exemption is a reduction in the taxable value of the property rather than a direct reduction in the amount of property tax. how do i file a homestead exemption? tax credits, deductions & exemptions guidance.. Iowa Property Tax Exemption.

From www.formsbank.com

Fillable Short Form Property Tax Exemption For Seniors 2017 Iowa Property Tax Exemption Division 28 of that bill. When you buy a home, you can apply for a homestead credit. iowans age 65+ have until july 1 to apply for a new property tax exemption included in legislation signed into law in may 2023. Types of grain included and. an exemption is a reduction in the taxable value of the property. Iowa Property Tax Exemption.

From startup101.com

How To Get An Iowa Sales Tax Exemption Certificate StartUp 101 Iowa Property Tax Exemption In 2021, the iowa legislature passed sf 619. Division 28 of that bill. how do i file a homestead exemption? all grain so handled shall be exempt from all taxation as property under iowa law. tax credits, deductions & exemptions guidance. an exemption is a reduction in the taxable value of the property rather than a. Iowa Property Tax Exemption.

From exouyuauz.blob.core.windows.net

Cook County Treasurer Property Tax Due Date at Timothy Ray blog Iowa Property Tax Exemption how do i file a homestead exemption? iowans age 65+ have until july 1 to apply for a new property tax exemption included in legislation signed into law in may 2023. an exemption is a reduction in the taxable value of the property rather than a direct reduction in the amount of property tax. When you buy. Iowa Property Tax Exemption.

From giogbekpj.blob.core.windows.net

Iowa Property Tax Veterans at Hobert Graham blog Iowa Property Tax Exemption tax credits, deductions & exemptions guidance. all grain so handled shall be exempt from all taxation as property under iowa law. an exemption is a reduction in the taxable value of the property rather than a direct reduction in the amount of property tax. an exemption is a reduction in the taxable value of the property. Iowa Property Tax Exemption.

From hxecklvdz.blob.core.windows.net

New Mexico Va Property Tax Exemption at Anna Oh blog Iowa Property Tax Exemption all grain so handled shall be exempt from all taxation as property under iowa law. iowans age 65+ have until july 1 to apply for a new property tax exemption included in legislation signed into law in may 2023. Division 28 of that bill. tax credits, deductions & exemptions guidance. an exemption is a reduction in. Iowa Property Tax Exemption.

From www.exemptform.com

Iowa Construction Sales Tax Exemption Form Iowa Property Tax Exemption tax credits, deductions & exemptions guidance. an exemption is a reduction in the taxable value of the property rather than a direct reduction in the amount of property tax. Types of grain included and. In 2021, the iowa legislature passed sf 619. an exemption is a reduction in the taxable value of the property rather than a. Iowa Property Tax Exemption.

From www.formsbank.com

Form 54001 Iowa Property Tax Credit Claim 2002 printable pdf download Iowa Property Tax Exemption Types of grain included and. an exemption is a reduction in the taxable value of the property rather than a direct reduction in the amount of property tax. all grain so handled shall be exempt from all taxation as property under iowa law. how do i file a homestead exemption? an exemption is a reduction in. Iowa Property Tax Exemption.

From www.templateroller.com

Form 54028 Download Fillable PDF or Fill Online Homestead Tax Credit Iowa Property Tax Exemption Division 28 of that bill. an exemption is a reduction in the taxable value of the property rather than a direct reduction in the amount of property tax. how do i file a homestead exemption? all grain so handled shall be exempt from all taxation as property under iowa law. tax credits, deductions & exemptions guidance.. Iowa Property Tax Exemption.

From itrfoundation.org

Consolidation of Property Tax Levies ITR Foundation Iowa Property Tax Exemption how do i file a homestead exemption? Types of grain included and. Division 28 of that bill. iowans age 65+ have until july 1 to apply for a new property tax exemption included in legislation signed into law in may 2023. When you buy a home, you can apply for a homestead credit. an exemption is a. Iowa Property Tax Exemption.

From printableformsfree.com

Iowa Sales Tax Exemption Form 2023 Printable Forms Free Online Iowa Property Tax Exemption When you buy a home, you can apply for a homestead credit. Types of grain included and. Division 28 of that bill. tax credits, deductions & exemptions guidance. In 2021, the iowa legislature passed sf 619. all grain so handled shall be exempt from all taxation as property under iowa law. an exemption is a reduction in. Iowa Property Tax Exemption.